Since the world became aware of coronavirus, everyone was in panic. What will happen next? Will this infect us? How can we go on with our lives amidst the pandemic?

But the most important question right now is what happens to your job, especially since you are working overseas.

Since the strict implementation of the lockdown, thousands of OFWs were either repatriated or not allowed to leave the country. Worse, millions of Filipinos are now jobless – the highest rate so far.

Times like this are extremely difficult, especially if you lost your job you so worked hard for. There is no assurance that everything will be okay in a few months time, but we do hope these tips will help you get through:

It’s Not Your Fault

Covid-19 affected everyone. Companies, even if they don’t want to, were forced to close down to minimize losses.

In case you lost your job, don’t blame yourself. This won’t help as well.

Acknowledge Your Emotions

You might be experiencing a rollercoaster of emotions due to job loss – anger, fear, worry, anxiety, and the list goes on. That’s normal. You have a family to feed and a long list of loans and other payables to pay so feeling these emotions is part of the process.

Acknowledge these emotions but don’t let these consume you. Otherwise, it will affect your way of thinking, which will make it harder for you to strategize on what to do next. Keep in mind that these feelings are temporary and you will get through this eventually.

Since you’re at it, take this time to reflect as well. Examine what you could’ve done to improve your performance. This is a good opportunity to look into how you were at work and vow to do better the next time.

Claim Your Employment Benefits

This is important. You might lose your job but this doesn’t your employer is exempted from not giving what is due to you. Make sure you demand your salary and benefits as stated in your employment contract.

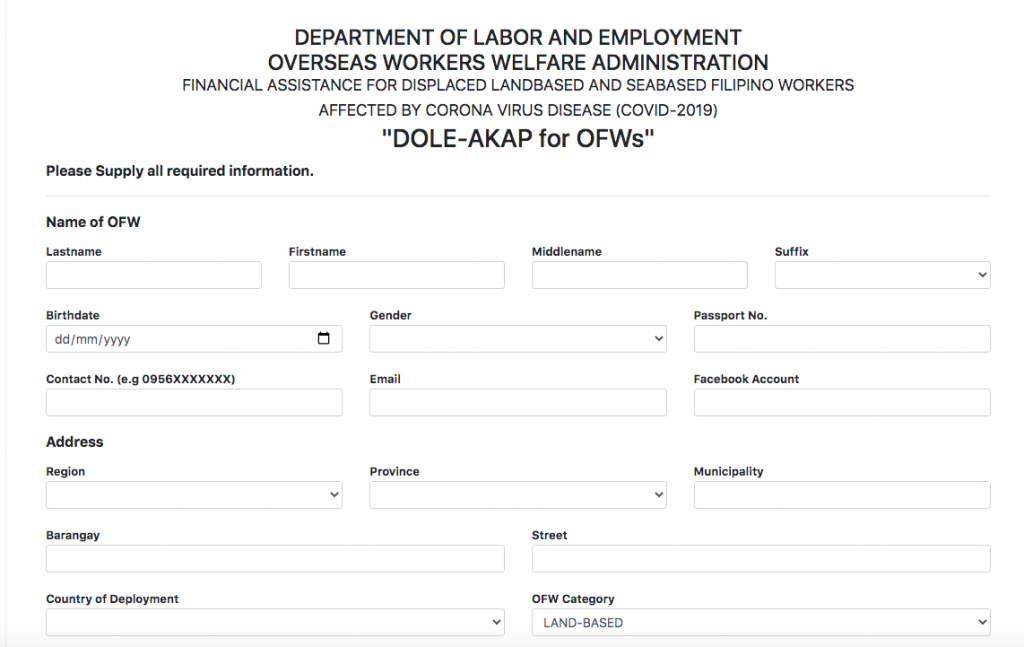

Aside from your employer, the government also offers financial assistance amounting to P10,000 to OFWs. You can avail of this benefit as well. This one-time cash assistance may not be that much but it is still helpful.

Reach Out To Your Family

This is also important. At this point, you need the comfort and love coming from your family. Tell them what happened and be honest about your situation. Do not sugarcoat your reality because they need to be aware of what’s happening as well. This way, they can also make adjustments.

Of course, they will need your job but they will understand your situation and help you get through it.

Look For A Distraction

Dealing with job loss especially during this time can be difficult. While it’s okay to acknowledge those emotions, don’t focus on those alone. Instead, look for a distraction.

It could be rediscovering an old hobby or learning a new skill. You might also want to take advantage of courses online to help you improve your portfolio. Treat this as an opportunity and put it into good use.

Examine Other Sources Of Income

In the meantime, look for other sources of income. Online selling is in these days, so that’s an option you can try. Online jobs are also popular, which could give you extra income. If you have a particular service you can offer, say housekeeping or maintenance work, then do so.

There are many opportunities so don’t be afraid to explore.

We understand the situation you are in. Do know that this, too, shall pass. Take this time to explore something new and who knows, it could lead to something bigger.