Here’s a sad reality: not everyone is privileged to belong to the upper 1 percent of the society. Most of us need to work hard to be able to buy what we need. Some even have to seek greener pastures and work overseas just to be able to provide a better and more secured future for the family.

In case you need purchase high-value items like a car or a house, or you’re looking for capital to fund your start-up, you end up borrowing money from banks or other private lenders like Balikbayad.

Speaking of loans, here are your options that are specifically designed for Modern Day Heroes like you:

If You Want To Start A Business –

OWWA Loan is recommended. In partnership with Landbank, the purpose of this type of loan is to encourage OFWs to put up their own business through the Enterprise Development and Loan Program.

Unlike other types of business loan, EDLP specifically caters to OFWs where you can borrow from P100,000 to P2 million with annual fixed interest rate of 7.5 percent. More importantly, you are encouraged to attend the entrepreneurial development training wherein you will be given information on how to run a business as well as how to keep it sustainable. Don’t worry because this is free.

If you prefer starting small, then OWWA Reintegration Program could be the right fit. It is open to repatriated and displaced OFWs wherein you will be given livelihood assistance amounting to as much as P10,000. This is enough to help you start a small business.

Balikbayad also offers business loans for OFWs to help you get a fresh start without leaving the country. Simply fill out the online application form and Balikbayad representatives will get back to you regarding the status of your application.

For Your Immediate Cash Needs –

Getting a personal loan is recommended. You can only borrow smaller amounts, although this would mean higher interest rate and shorter loan term.

When it comes to personal loan, try SSS Salary Loan. The agency allows you to borrow money even while you’re abroad and with no collateral requirement. You can borrow an equivalent of your average monthly salary up to twice its amount with an annual interest rate of 10 percent. Loan term is 24 monthly amortizations.

The best part is you can apply for this online.

In Case You Need A New Vehicle For The Family –

Banks offer competitive car or auto loans to its borrowers. Check with your preferred bank if there is a loan facility that is specifically catered to OFWs.

PNB has Global Filipino Auto Loan that allows you to borrow up to 80 percent of the vehicle’s purchase price.

You can also apply at BDO’s Kabayan Auto Loan where you can borrow starting at P100,000 to maximum of 80 percent of the vehicle’s purchase price. Annual interest rate is between 4.74 percent and 6.8 percent, which will depend on your loan term between two and six years.

Ford also offers OFW Assist wherein you can have the opportunity to own your own Ford car and apply for a loan with EastWest Bank.

If You Want To Invest On Your Future Home –

Of course, who doesn’t want to have their own home?

PAG-IBIG Housing Loan is the most sought after loan facility in case you want to have your own home. This loan facility offers the lowest interest rate of maximum of 10 percent per annum. Loan term is longer because you can stretch this for up to 30 years unlike banks’ 10 to 15 years.

If you still prefer borrowing from the bank, then there are options to choose from. PNB has Philippine Home Loan, which allows you to apply even while overseas. The amount you can borrow is anywhere between P500,000 and 80% of the appraised value of the property you’re aiming for.

SSS also has a Direct Housing Loan Facility, which also offers competitive rate and flexible terms for OFWs. Just make sure you made at least 36 months contribution to qualify for this loan.

Collectively, these are called OFW Loans. OFW Loans are loan facilities specifically catered to OFWs to help address your needs. Unlike ordinary types of loan, OFW loans are designed to fit the needs and capacity of the borrower.

Take a look at these loans and see which one suit your needs best. Keep in mind that the loans have a specific purpose, so make sure to use them accordingly.

5/F Salustiana T. Dy Tower, Paseo de Roxas Legaspi Village, Makati City (near Greenbelt 1).

5/F Salustiana T. Dy Tower, Paseo de Roxas Legaspi Village, Makati City (near Greenbelt 1). 9/F TM Kalaw Center, 667 TM Kalaw St., Ermita, Manila

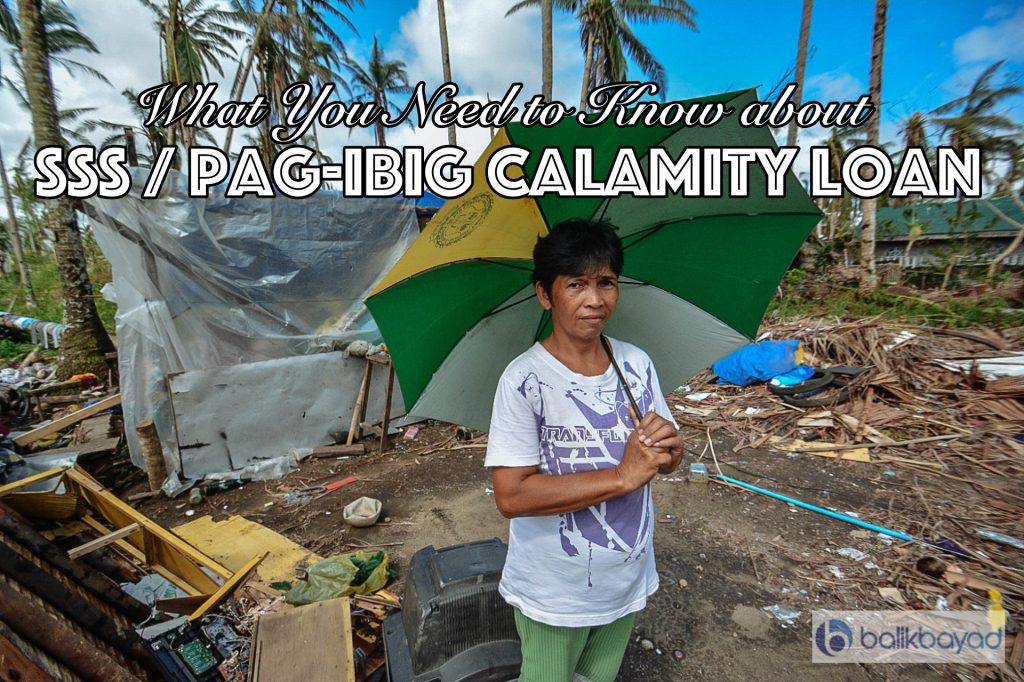

9/F TM Kalaw Center, 667 TM Kalaw St., Ermita, Manila Last September 15, 2018, Northern Luzon were punished by Typhoon Ompong, the strongest typhoon to hit this year, thereby destroying houses, farmlands, public and private buildings and establishments, and even electric posts. While the typhoon lasted for only a day, it left thousands of displaced families and millions-worth of damages.

Last September 15, 2018, Northern Luzon were punished by Typhoon Ompong, the strongest typhoon to hit this year, thereby destroying houses, farmlands, public and private buildings and establishments, and even electric posts. While the typhoon lasted for only a day, it left thousands of displaced families and millions-worth of damages. We get a lot of inquiries about PAG-IBIG Housing Loan for OFWs. This post is intended to boost your chances of approval, although not 100 percent guarantee.

We get a lot of inquiries about PAG-IBIG Housing Loan for OFWs. This post is intended to boost your chances of approval, although not 100 percent guarantee.