Few days left until March. This means it’s graduation season again. This also means you are obligated to give something to your kid as a reward for all the effort and hard work done not just during the school year but for the entire time s/he is in school.

Apparently, giving gifts means you need to spend (again). Surely, your kids will ask you things like new phone, or a tablet, or a trip somewhere they haven’t been before. If you’re on a tight budget, giving them what they want could hurt your wallet.

What’s your alternative? You can still give your kid a gift, but instead of giving in to their demands, you give them something more practical and useful.

Here are some practical graduation gift ideas you can give:

Your Child’s Own Bank Account

Saving for the future is not solely your responsibility. In fact, it is everyone in the family’s responsibility. For your graduation gift, why not open a bank account under your child’s name? This could be her personal savings account, which she can use for whatever purpose, hopefully, something useful. Giving your kid a bank account too also teaches the importance of saving and becoming more responsible with money.

Is there anything more practical than this?

A Nice, Durable Bag

Bag will always be a staple in everyone’s life. Whether your kid is heading to college or on his way to look for a job, he will need a durable bag to bring with him. As much as possible, keep it simple and could easily adapt to any given situation.

Does it have to be branded? It depends since not all signature bags automatically mean they are durable. More than the brand, look closely into the material and how it was made. Check the size and if there is enough room for all of your kid’s stuff. .

Journal

In this digital age, there are only few people who print pictures and actually write about what happened to them. Bring it back by giving your son or daughter a journal. Plain journal is recommended so they could personalize it according to their own liking.

Laptop

Speaking of digital age, kids these days can practically do anything after making clicks on the keyboard. As your graduation gift, consider giving your son or daughter his or her own laptop.

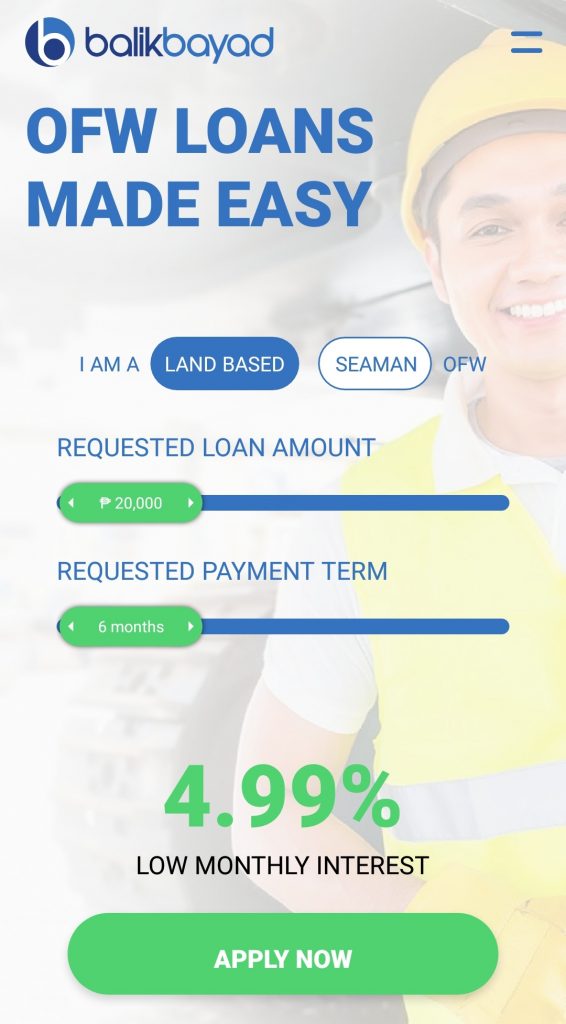

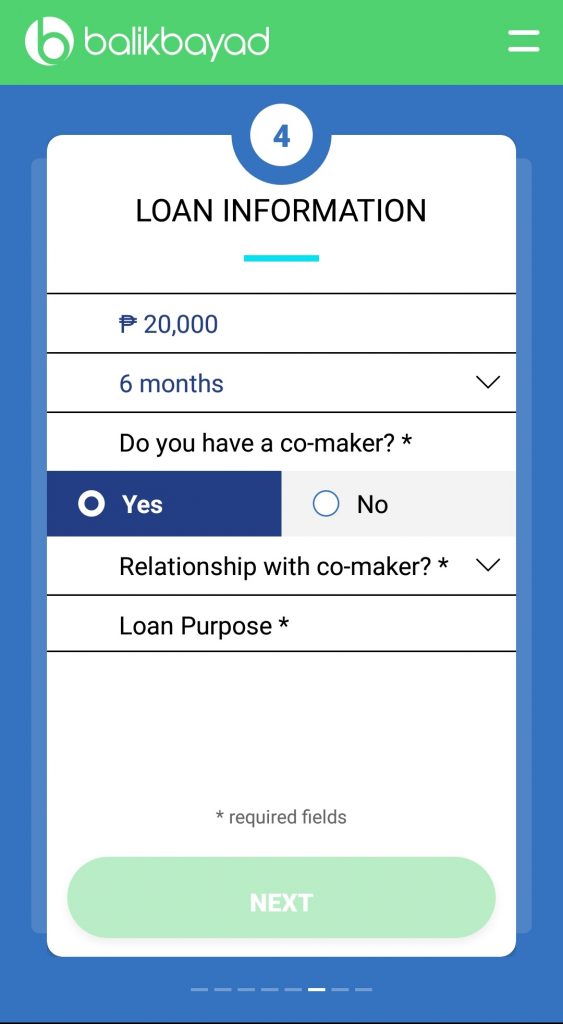

Before you say “ang mahal naman,” you should know that there are laptops that are within the budget. In fact, you can get a new laptop without shelling more than P20,000. Simply settle for basic laptops especially if s/he will use it for school or work.

If budget permits, you can buy a laptop bag too.

A Nice Watch

Mobile phone will tell you what time it is, but does your child have to get the phone all the time to check the clock?

It could be tempting to buy a smart watch, but we know how technology is these days and how fast it involves. Sure, you can do a lot with it, but nothing beats the classics. We suggest that you go for a timeless, classic piece that your son or daughter can use at any occasion.

Coffee Maker

Who doesn’t like coffee? If you noticed that your son or daughter loves coffee, give him/her a coffee maker for a cup of fresh brew every morning. 3-in-1 coffee is packed with sugar and going to Starbucks or any other coffee shops for a cup of Joe is not recommended and costly.

Don’t forget to add the beans.

Investment

Aside from his/her own bank account, starting an investment portfolio for your kid is also recommended.

Compared to savings account, investment options like mutual funds or stocks earn more. In a few years, you could already double or triple your money. This could also be a good start for your kids to consider investing as early as now.

So, what are you planning to give to your graduating kid?