Personal loan is a type of loan that you can use to finance smaller purchases such as home renovation, payment of tuition fee for your child, or finance a family vacation among others. In other words, it is a multi-purpose loan that allows you to use the funds on things that matter to you.

Compared to home or car loan, personal loan has shorter term and more flexible monthly installment scheme. Nonetheless, you can only borrow as much as P1 million, depending on your bank of choice.

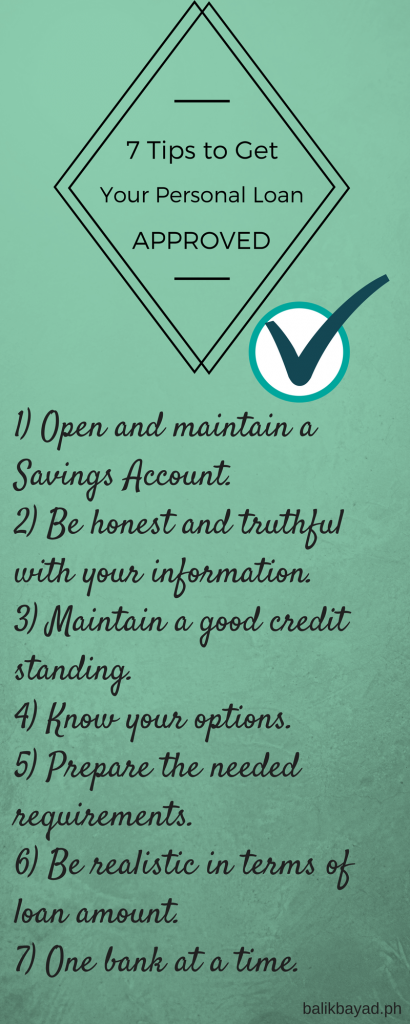

Here’s the thing: with the uncertainty that comes from working overseas, how can you get your personal loan approved?

Here’s how:  1. Open and maintain a savings account.

1. Open and maintain a savings account.

Savings account serves dual purpose: for money-keeping and a credit booster. Aside from serving as your fund for the rainy days, a savings account shows your ability to manage money and eventually loan payments, especially if you regularly contribute in it.

2. Be honest and truthful with your loan application information.

There is a reason why banks ask your address, home or mobile number, occupation, and estimate of monthly salary among others. They need to verify if you are a real person and capable of paying the loan. Therefore, supply only factual and truthful information in your loan application. If they cannot contact you, then no loan processing will take place.

3. Maintain a good credit standing.

Credit standing is your reputation that reflects your ability to meet various financial obligations. The better your credit standing, the higher the possibility of getting your personal loan approved. On the other hand, unpaid credit card debts or bounced checks are considered red flags and banks don’t like them.

Even if you don’t intend to get any type of loan, it is still important to maintain a good credit standing. This will facilitate and speed up loan processing in the future in case the need for additional funds arises.

4. Know your options.

There are tons of banks and lending institutions that offer personal loan at competitive rates and packages. Before you apply for one, make sure to check the facilities that offer your needs, easy and flexible payment terms, and other features that allows you to get more than what you apply for. This may take time, but familiarizing yourself with the procedure will be helpful when you apply for a personal loan.

5. Prepare the needed requirements.

Apart from incomplete or insufficient information, one of the reasons why loan processing takes time is because of incomplete requirements. Once you made up your mind on where to avail of a personal loan, make sure you prepared all the documents needed to process the loan. After all, banks won’t process your application and release the funds if you can’t surrender all the documentary requirements required from you.

6. Be realistic in terms of loan amount.

You want P1 million, but do you really need that amount when all that you want is to finance your child’s tuition fee? This is where the importance of providing accurate information comes in. Banks assess your ability to repay the loan according to your employment and savings account. If you are unable to show any documents to prove such ability, then don’t expect the bank to grant you the maximum loan amount. After all, an outright decline is possible.

7. One bank at a time.

Here’s another tip: don’t apply for a personal loan in several banks all at the same time. You might want to take chances and believe that at least one (or two) will grant your loan. Believe it or not, this will reflect during your credit investigation and banks may think that you are financially trapped – and it’s not good. There is a higher chance of getting your application declined as well.

The next time you apply for a personal loan, take these seven tips in mind. There is no guarantee of approval, but these tips will help you boost your chances of getting your loan approved.

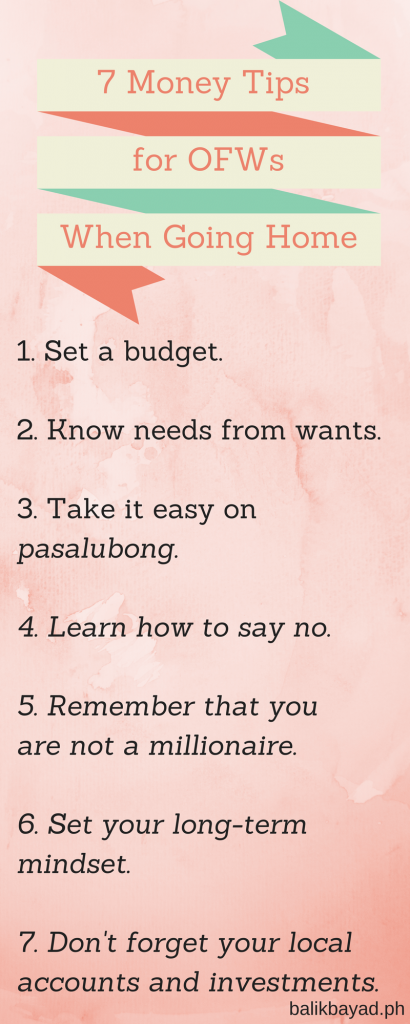

1. Set a budget.

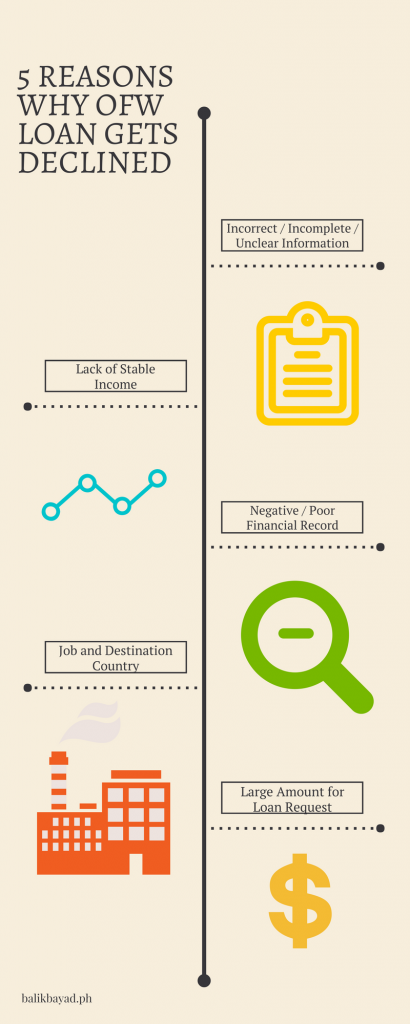

1. Set a budget.  1) Incorrect / Incomplete / Unclear Information

1) Incorrect / Incomplete / Unclear Information  Mutual Fund

Mutual Fund

Who are Loan Sharks?

Who are Loan Sharks? 1. Over-remitting

1. Over-remitting