Are you thinking of applying for a loan, whether personal, car loan, or a home loan? Before the bank approves your application, they need to make sure that your credit standing-slash-capacity to pay is exceptional. One of the best ways to prove and boost your credit standing is by applying for a credit card – and making sure that you use it wisely.

Here are top tips and tricks to help you use your credit card the right way:  Tip No. 1: Get a credit card that suits your needs.

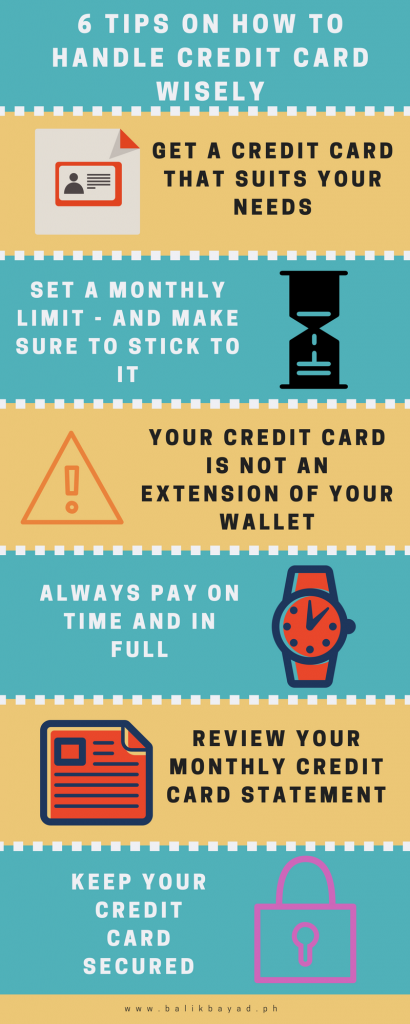

Tip No. 1: Get a credit card that suits your needs.

Despite the “Mastercard” or “Visa” on your credit card, banks these days offer various credit cards to cater to specific needs. Explore your options and choose a credit card that is best for your needs. In this case, consider BPI Family Credit Card or Security Bank’s Complete Cashback to help you stretch your cashflow.

Tip No. 2: Set a monthly limit – and make sure to stick to it.

It is tempting to spend, now that you know you have a card to back up your purchases. Apparently, banks look into your spending and if they see that your purchases are greater than your payment, then you might be at risk of getting your loan declined.

Therefore, set a monthly limit and stick to it. This limit should depend on your capacity to pay in full. If you hit your limit, cut any form of spending until the next month.

Tip No. 3: Remember: Your credit card is not an extension of your wallet.

Keep in mind that the amount swiped on your credit card is equal to the amount you have to pay come billing time. Don’t overspend.

Tip No. 4: Always pay on time and in full.

Have you seen the term “Finance Charges” on your billing statement? That means “interest” in addition to your purchases and you will constantly have it every month unless you pay the amount in full. The worst part is this finance charge keeps adding up, thereby making your total amount due bigger. To avoid that, pay in full and on time.

You might also consider setting an automatic payment for your credit card to avoid the hassle and getting charged for interest or late payment fee. This is why it is important to set a limit so you don’t have to worry about bills eating up your savings.

Tip No. 5: Review your credit card statement all the time.

Is your credit card providing charging the right purchases? You’ll never know if they do unless you check your statement as soon as you get them.

Therefore, make it a habit to review your credit card statement and make the necessary adjustments when needed. Aside from ensuring the right charges, reviewing your statement allows you to see where your money goes and help you adjust your spending pattern.

Tip No. 6: Keep your credit card secured.

From the time you get your card, make sure you sign at the back, list your credit card number, and save the hotline number of your credit card company. This will make it faster for you to notify the bank in case your card was lost or stolen.

Consequently, keep your credit card information to yourself. You don’t want people stealing your information and make you pay for their purchases, do you?

Owning a credit card entails responsibility. The challenge now is how responsible are you in using your credit card. The choice is yours.

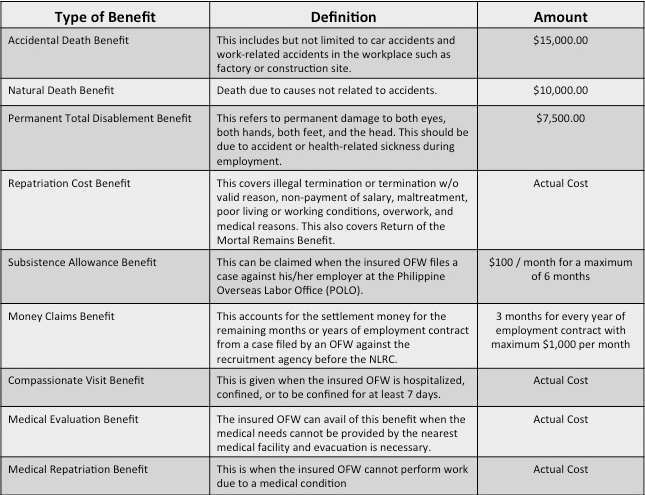

5. Here’s how to file a claim for Agency-Hired OFW Compulsory Insurance:

5. Here’s how to file a claim for Agency-Hired OFW Compulsory Insurance: Who doesn’t need money? Regardless of the currency of the money you are earning, everybody needs cash to pay for the rent, buy food for the table, and send the kids to school. Because of this need for cash, banks and other lending institutions came up with different facilities that will suit your specific needs.

Who doesn’t need money? Regardless of the currency of the money you are earning, everybody needs cash to pay for the rent, buy food for the table, and send the kids to school. Because of this need for cash, banks and other lending institutions came up with different facilities that will suit your specific needs. Being single and in your 20s may be the best time of your life. You can do anything you want and not worry about anything. Apparently, if you are one of the thousands of Filipinos working overseas to help provide a better life for your family, then being single and in your 20s calls for bigger responsibilities. In fact, you hold the title of being the “breadwinner,” who constantly have to send money for your siblings’ tuition fee or your father’s medication.

Being single and in your 20s may be the best time of your life. You can do anything you want and not worry about anything. Apparently, if you are one of the thousands of Filipinos working overseas to help provide a better life for your family, then being single and in your 20s calls for bigger responsibilities. In fact, you hold the title of being the “breadwinner,” who constantly have to send money for your siblings’ tuition fee or your father’s medication. 1) Get a credit card and make sure to use it wisely.

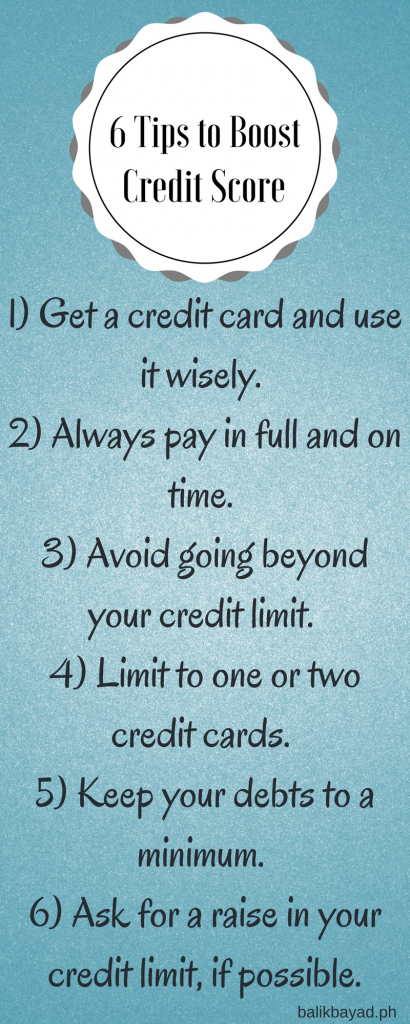

1) Get a credit card and make sure to use it wisely. 1. Open and maintain a savings account.

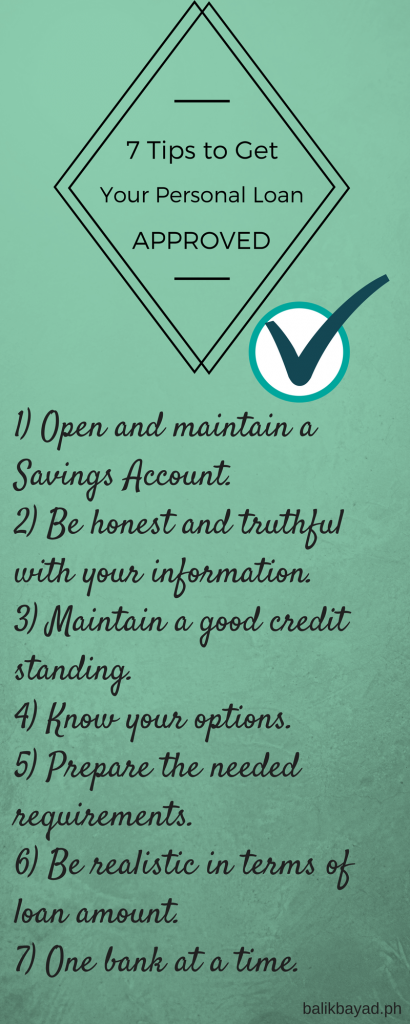

1. Open and maintain a savings account.  1. Set a budget.

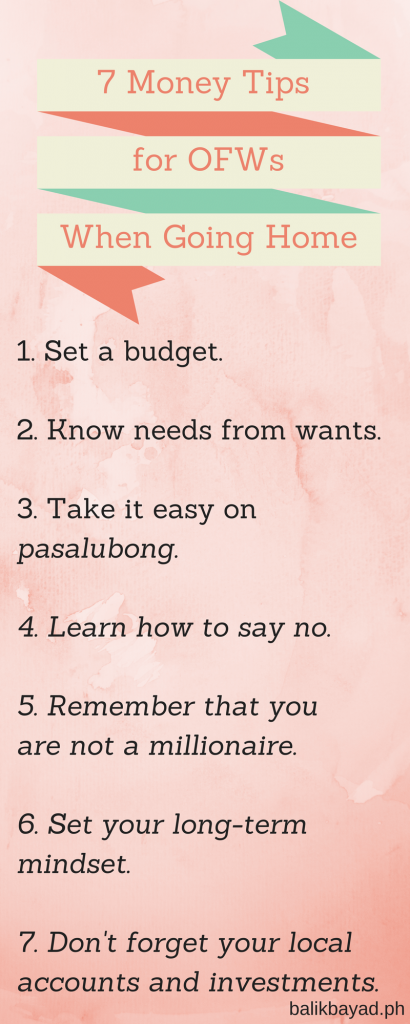

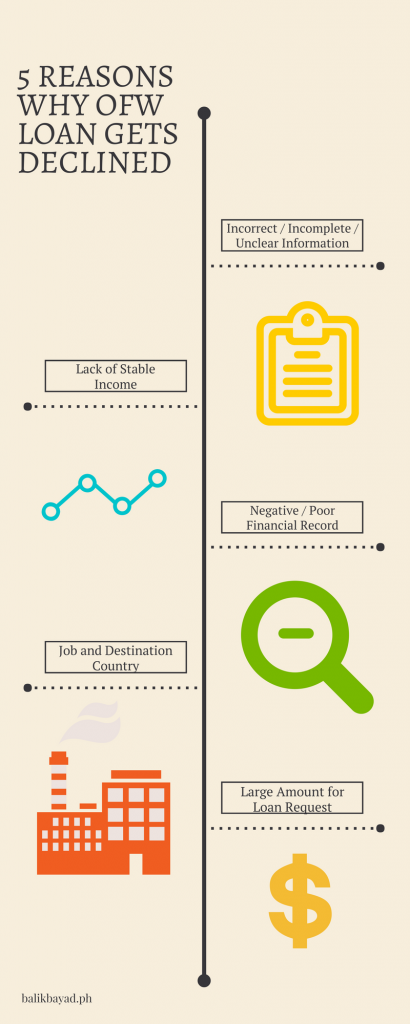

1. Set a budget.  1) Incorrect / Incomplete / Unclear Information

1) Incorrect / Incomplete / Unclear Information  Mutual Fund

Mutual Fund