Overseas Filipino Workers are hailed as “heroes” or in Filipino, “bagong bayani.” Because of this, various options and loan facilities are offered specifically for you. Oftentimes, you get special treatment and special rates as well.

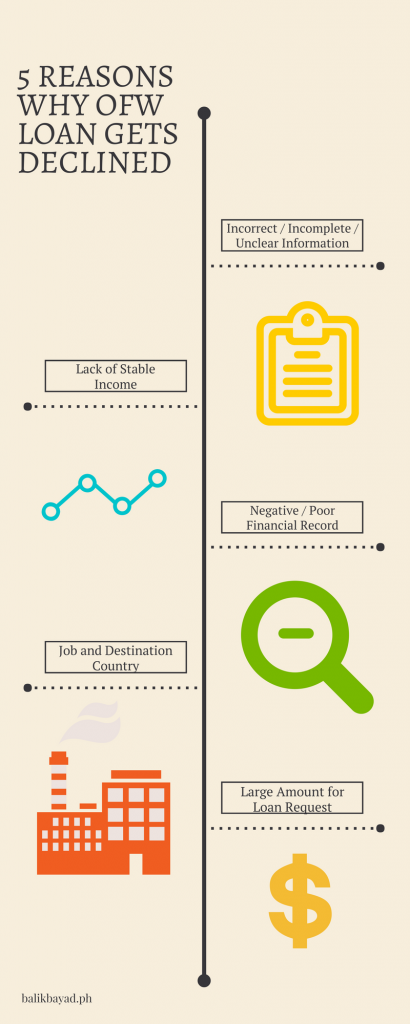

How come your OFW Loan still gets rejected no matter how many times you apply?

Here’s why:  1) Incorrect / Incomplete / Unclear Information

1) Incorrect / Incomplete / Unclear Information

The information you will provide is very important. Banks and other lending facilities use this information to check your background and at the same time, determine your capacity to pay the loan. Any inconsistencies such as address or mobile number could delay your OFW loan or even gets declined.

Therefore, make sure that all the information you will provide in the loan application is true and complete. Submit all the required paperwork to prove your credit worthiness. Don’t worry. Your information will remain confidential.

2) Lack of Stable Income

Despite what was written in the employment contract, you have little control over it. Depending on the situation and your employer, the term or nature of your employment might change or prematurely terminated. This is the reason why lending institutions reject your OFW Loan. They need to see your capacity and ability to pay the loan in a timely manner – and six months working overseas is not enough to prove that. Jumping from one job to another is also not a good sign for the banks.

Therefore, stabilize your job and prove that you are worthy of credit. If you really need that loan, apply with a co-borrower, preferably a close relative with stable source of income and good credit standing. This could boost your chances of getting your OFW Loan approved.

3) Negative / Poor Financial Record

Do you have unpaid credit cards or loan facilities you haven’t paid for the longest time? That could affect your credit standing and result to OFW loan rejection.

Lending institutions are sensitive when it comes to potential borrower’s credit standing because they need to make sure that they will be paid upon maturity of the loan.

Therefore, pay all your past due accounts before applying for a loan. Constant payment is a big plus and once the bank sees you are diligent in paying off your debt, it could approve your loan application.

4) Job and Destination Country

Working overseas and showing your capacity to pay are not sure ways to get your loan approved. Even if you have sufficient savings, lending institutions also look at the nature of your job and the country where you will be assigned. These two factors are crucial because any changes in the foreign policy or the country’s current situation could affect your employment, including salary rate.

Therefore, choose a job and destination country wisely. Do not put yourself at risk just because a country with evident political tension is offering higher pay. Consider your safety first before anything else.

5) Large Amount for Loan Request

There are two types of loan: secured, which means it has to be backed up by a collateral (car, real property, or equipment); and unsecured, which doesn’t require any security but comes with high interest rate.

Most of the time, banks and other lending institutions go for secured type of credit for protection purposes. The security you will offer will help as to how much you can loan, depending on the appraised value of your offered collateral. If the property you offer for a collateral is pegged at P500,000, don’t expect the bank to lend you P1 million.

Therefore, don’t apply for OFW loan using collateral that is appraised at lesser value than how much you want to borrow. Check your properties that you can offer as a collateral and make sure that they value more than the amount you plan to borrow. More importantly, be realistic with the loanable amount. Keep in mind that banks prefer someone who can pay them in time and would not want to go through the time and hassle of re-possessing your property.

At the end of the day, applying for OFW Loan requires strategy. Determine your need for loan, check your finances, and see if you are capable of paying. You can also check Balikbayad to see how they can assist you with your funding needs.

2 Replies to “Top 5 Reasons Why Your OFW Loan Gets Declined”