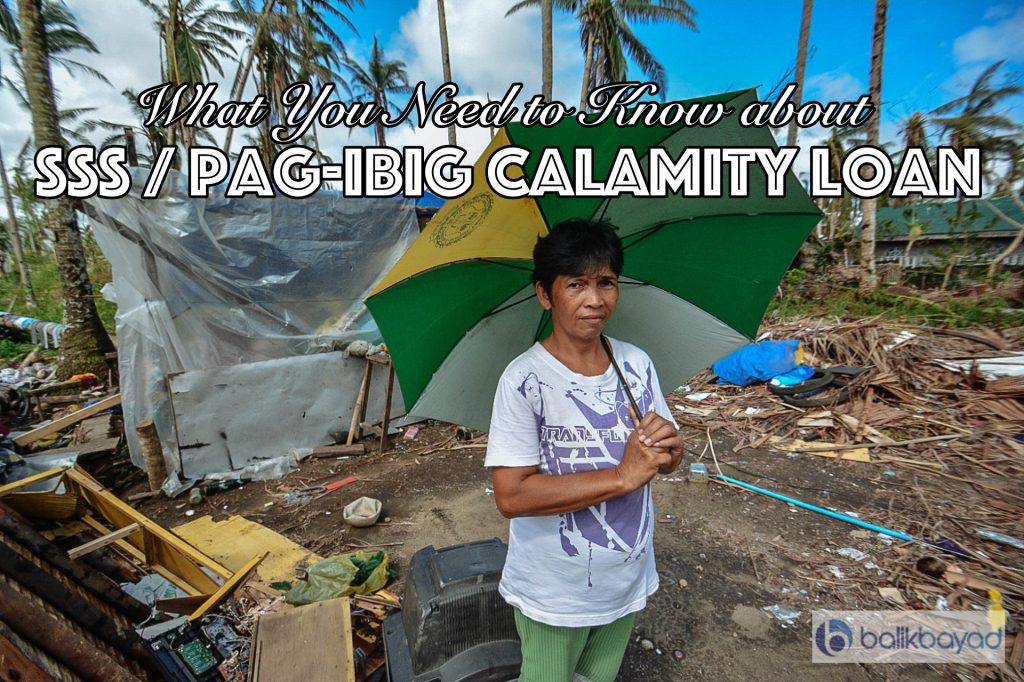

Last September 15, 2018, Northern Luzon were punished by Typhoon Ompong, the strongest typhoon to hit this year, thereby destroying houses, farmlands, public and private buildings and establishments, and even electric posts. While the typhoon lasted for only a day, it left thousands of displaced families and millions-worth of damages.

Last September 15, 2018, Northern Luzon were punished by Typhoon Ompong, the strongest typhoon to hit this year, thereby destroying houses, farmlands, public and private buildings and establishments, and even electric posts. While the typhoon lasted for only a day, it left thousands of displaced families and millions-worth of damages.

Unfortunately, Ompong is just one of the many typhoons that will visit the Philippines. While you and your family will be able to recover in time, which also means you need to work extra hard overseas, rehabilitation entails costs.

The good news is the government is willing to help through SSS or PAG-IBIG Calamity Loan. This loan facility is available to Filipinos who were affected by a calamity as declared by the National Disaster Risk Reduction and Management Council (NDRRMC) and suffered loss and damages as a result of the calamity.

Here’s what you need to know between the two:

SSS Calamity Loan

Features:

- Loan Amount – One monthly salary credit (MSC) based on the average of the last 12 MSCs or total amount of damage, whichever is lower

- Interest Rate – 10 percent per annum

- Penalty Fee – One percent per month until fully paid

- Loan Repayment – Payable within two years in 24 equal monthly installments

- Waiver of one percent service fee

- Must be availed within three months from the happening of the calamity

Who can apply?

- Has at least 36 months of contribution, six of which must be posted within the last 12 months prior to application of Calamity Loan

- Resident of calamity-declared area and suffered losses or damages to the property

- No outstanding loan with SSS (Loan Restructuring Program and Calamity Loan Assistance Program)

- Applicant must not have been granted any final benefit (retirement, death, total permanent disability) at the time of the application

How to Apply for SSS Calamity Loan (procedure is enumerated for OFWs only)

- Fill out Calamity Loan Assistance application form. You can get a copy of the form here.

- Personal appearance in the nearest SSS branch is required, but for OFWs, submit an Authorization Letter to certify that person transacting with SSS was authorized by you.

- Submit scanned copies of IDs or documents that proves your status as OFW as well as original copies of IDs of your authorized representative.

- Submit Barangay / City / NDRRMC / LDRRMC Certification that you were affected by the calamity. You can also get a copy here.

You can visit the nearest SSS branch, send email at member_relations@sss.gov.ph, or call SSS Call Center Hotline at 920-6446 to 55 for more details.

PAG-IBIG Calamity Loan

Features:

- Loan Amount – Up to 80 percent of the Total Accumulated Value (TAV)

- Interest Rate – 5.95 percent per annum

- Repayment Period – Equal monthly installments payable for 24 months with grace period of three months. This means if you apply on January, you may start paying the loan on April or on the fourth month. Payment must be made every 15th of the month.

Who can apply?

- Must made at least 24 months contribution with at least one monthly contribution in the last six months prior to the date of application. In case you haven’t made at least 24 months contribution, then you must show proof that your total savings is equivalent to 24 months of contribution.

- A resident of the area that was declared as calamity-stricken

- In case there is an existing PAG-IBIG Housing Loan, MPL, or calamity loan, existing loan must NOT be in default

- Has sufficient proof of income

How to Apply

- Submit duly-accomplished application form in any PAG-IBIG branches near you. You can get a copy of the application form here.

- Submit supporting document such as Proof of Income and photocopy of two government-issued IDs

- Accomplish and submit Declaration of Being Affected by Calamity. You can try using this form.

- For OFWs, your family member might be required to submit a Special Power of Attorney to transact on your behalf. You can use this SPA form.

Keep in mind that these facilities can only be applied for within three months from the happening of the calamity. In case you were affected, the calamity loans could be helpful in getting your family back on their feet.

pano po mag apply ng calamity loan online..thanks po

Hi! No online application for this facility. You need to go directly po to SSS or PAG-IBIG to file for calamity loan 🙂

can we apply both in SSS and PAGIBIG calamity loan?

Hi Barbara! You may try po but that’s not recommended 🙂

Hi! Question lang po, kapag ba may existing ako na salary loan na hindi ko pa naaayos sa SSS pero payer ako within 12 months.. Qualified po ba ako? Thank you!

Hi Katherine! It could affect your loan application po, although hindi naman automatic na bawal na po agad mag-apply. We suggest po that you start paying the salary loan po para hindi na po maapektuhan ang inyong calamity loan application.

What if may existing salary loan sa pagibig, ikakaltas ba ung balance ng salary loan sa calamity loan

Hi Mia! No naman, but the existing salary loan could affect the chances of approval when you apply for a calamity loan.

need clarification:

if the existing salary loan was already deducted to the said calamity loan (80% TAV), are we still entitled to pay for the salary loan that was deducted or its the calamity loan that’s going to be paid moving forward.?

Hi Mark! Was the salary loan absorbed by the calamity loan already? If yes, then calamity loan nalang ang babayaran.

Hi. 36 months pa lang ako naghuhulog sa sss..pwede na po ba ako magfile ng calamity loan?ano po ba ang ibig sabihin nito”Has at least 36 months of contribution, six of which must be posted within the last 12 months prior to application of Calamity Loan” Thanks!

Hi Vanessa. Let’s say balak niyo po magapply ng Calamity Loan this January 2019, dapat ay nakapaghulog po kayo for at least six months noong 2018 🙂 Hope this helps!

Ah okay. Bale po 36 months na ako naghulog..bale pang 36 months po dis december 2018..so pwede dn pala ako ako magloan ng calamity at salary?

pag my outstanding balance po ba s pag ibig salary loan pero tuloy prin hulog q as of now..makaka avail po ba aq ng calamity loan?

Hi Myralee. There should be NO outstanding loan 🙂

hi p0..my existing po q salary loan na di q p0 nbabyrn sa sss…pwede po kaya mkapg apply aq ng calamity loan..thanks p0h

Hi Jhen. Pwede naman, but this could affect your application since makikita that you have unpaid loan with SSS.

Pano po pag may existing MPL loan sa pag-ibig pero nde pa nhuhulugan, pwd po ba mag calamity loan?

Hi Jenny. We’re not sure if PAG-IBIG will allow this since you have an existing loan already. You may contact PAG-IBIG regarding this for clearer response. Thanks!

Pede po ba akong mag avail ng calamity loan kahit kakaloan ko lang ng short term loan last 1st week ng March?

Hi Melanie. The requirements indicate that there should be no existing loan with the agency before you can apply for a Calamity Loan.

pwede na po bang mkaloan ng calamity loan ung 2years na pong nhulugan ang sss ko???

Hi Jeffrey. The requirement says 36 months or three years 🙂

paano mag apply ng calamity loan sa covid sa online..

pwede ba makahenge ng tolong.

Hi. Hindi sakop ng Calamity Loan ang Covid-19 po.

Pede po ba magloan para sa calamity loan ang voluntary…???

Hi Mary. Yes, as long as updated ang contributions and kumpleto ang requirements 🙂

Pwede po bang mag apply ng calmity loan ang self employed pero halos 10years n po naghuhulog

Yes, as long as you submit all the needed requirements 🙂