Every year, thousands of Filipino workers are deployed in various countries around the world to provide and render services according to their set of skills. At the same time, the promise of a better life and better future for their family became their driving force to work overseas.

Below are key trends and overseas employment statistics according to POEA for 2015:

Documentation

In 2015, there are 2,343,692 Overseas Filipino Workers whose contracts were processed by POEA. This number is lower by almost 50,000 compared to the processed contracts in 2014.

Out of the contracts processed, land-based workers still got the biggest slice of pie with 1,823,715, with 1,208,967 rehires and 614,748 new or first time workers. Consequently, there are 519,977 documented sea-based workers, which is higher compared to 2014’s 517,972.

Nonetheless, not all documented workers were all deployed.

Type of Hiring

In total, there were 1,844,406 migrant workers deployed in 2015, a number higher compared to the previous year.

There were more land-based workers deployed with 515,217 new hires and 922,658 re-hires. Likewise, 406,531 sea-based workers were deployed in 2015, which is also higher than 2014’s numbers.

Deployment of Land-based OFWs

Land-based migrant Filipino workers still hold the highest percentage of OFWs deployed. Below are the key numbers based on certain categories:

According to Major World Group

Middle East still holds the higher number of deployed land-based workers with a total of 913,958 or a 3.21 percent change than 2014. Middle East is followed by Asia with 399,361 land-based workers deployed, Europe with 29,029, Americas with 17,234, Africa with 18,226, and Trust Territories with 4,777 deployed. The number of land-based workers decreased in Oceania at 18,850 while there are 36,440 Filipino workers deployed in other territories not mentioned.

According to Major Occupational Group for New Hires

There are 10 major occupational groups according to the International Standard Classification of Occupations 2008. For the new hires, there are 39,740 deployed professionals and 27,830 technicians and associate professional working overseas. 58,422 new hires were deployed as service and sales workers while elementary occupations can be accounted for 273,167 new hires.

Aside from this, there are 55,059 craft and related trades workers, 21,893 plant and machine operators and assemblers, and 1,262 skilled agricultural, forestry, and fishery new hires are working abroad. 8,293 new hires are working as clerical support workers while 2,918 are managers. Five new hires took armed forces occupations and there are 26,628 more working abroad whose occupation is not classified.

Compared to 2014, there are more new hires deployed in 2015, recording a 5.76 percent increase.

According to Skills for New Hires

The POEA classified the top 10 skills based on the newly hired land-based workers deployed for 2015.

Household service workers took the top spot for new hires with 194,835 workers deployed, which is also a 7.5 percent increase from 2014. This is followed by manufacturing laborers with 41,038, 22,175 nursing professionals, 18,352 waiters, and 14,116 cleaners and helpers in offices and hotels.

There are also 10,181 deployed home-based personal care workers, 8,156 welders and flamecutters, 7,286 civil engineer laborers, 6,629 plumbers and pipe fitters, and 5,870 working in building constructions.

Top 10 Destinations for Land-Based OFWs

In terms of destination, Saudi Arabia is still the top choice of many migrant workers, with 406,089 working in the said country. This is followed by United Arab Emirates (UAE), Singapore, Qatar, Kuwait, Hong Kong, Taiwan, Malaysia, Oman, and Bahrain. Nonetheless, there are 225,866 land-based workers elsewhere around the world.

For new hires, Saudi Arabia is also the top spot, with 189,001 new hires deployed. Other destinations for new hires are as follows: Kuwait, Qatar, Taiwan, UAE, Hong Kong, Singapore, Malaysia, Japan, and Bahrain.

The case is the same with rehires with 217,088 still heading to Saudi Arabia. Nonetheless, re-hires are going to other countries such as Italy with 13,997 rehires workers deployed.

The succeeding sections will tell you more about the seafarers.

Deployment of Filipino Seafarers

Out of the 406,531 seafarers deployed, 93,993 of them were officers, 148,283 were categorized as “Rating,” and 161,480 were non-marine.

In terms of skills, able seaman took the top spot with 58,994 deployed. It is followed by oiler (31,563), ordinary seaman (28,556), chief cook (15,634), bosun (15,020), second mate (14,864), third engineering officer (13,228), messman (11,753), third mate (11,743), and waiter / waitress (10,859).

When it comes to flag registry, Panama took the top spot with 69,502 seafarers deployed. This is followed by Bahamas, Liberia, Republic of Marshall Islands, Malta, Singapore, Bermuda, Italy, Norway, and Netherlands.

In terms of the type of vessels, many seafarers are working in a bulk carrier with 94,668. Seafarers also worked in vessels such as passengers, container, oil/product tanker, tanker, chemical tanker, general cargo, supply vessel, pure car carrier, and tugboat.

5. Here’s how to file a claim for Agency-Hired OFW Compulsory Insurance:

5. Here’s how to file a claim for Agency-Hired OFW Compulsory Insurance:

Being single and in your 20s may be the best time of your life. You can do anything you want and not worry about anything. Apparently, if you are one of the thousands of Filipinos working overseas to help provide a better life for your family, then being single and in your 20s calls for bigger responsibilities. In fact, you hold the title of being the “breadwinner,” who constantly have to send money for your siblings’ tuition fee or your father’s medication.

Being single and in your 20s may be the best time of your life. You can do anything you want and not worry about anything. Apparently, if you are one of the thousands of Filipinos working overseas to help provide a better life for your family, then being single and in your 20s calls for bigger responsibilities. In fact, you hold the title of being the “breadwinner,” who constantly have to send money for your siblings’ tuition fee or your father’s medication. Mutual Fund

Mutual Fund

Who are Loan Sharks?

Who are Loan Sharks? 1. Over-remitting

1. Over-remitting

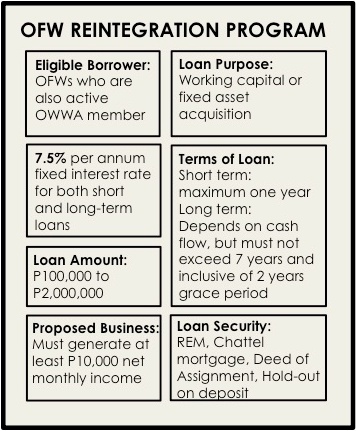

Understanding the OFW Reintegration Program

Understanding the OFW Reintegration Program