You know that PAG-IBIG offers Housing Loan facility to all its OFW members. Did you know that if you are a member of SSS, you can also apply for this type of facility?

Read on to learn more about SSS’ Direct Housing Loan Facility for OFWs.

Overview

The Direct Housing Loan Facility for OFWs is among the many services offered by the Social Security System. Its main goal is to support the shelter program of the government, which aims to provide low cost and socialized housing to Overseas Filipino Workers.

Who are OFWs?

To avail of this type of loan facility, OFWs are private sector worker who is:

- Currently deployed abroad whose contract was processed through POEA or authenticated by the Embassy abroad where you are working

- Has employment contract, which is subject to renewal or deployment

- Filipino national who is currently an immigrant or a citizen of another country, but wishes to buy a property for his/her family who are still in the country.

- Overseas Filipinos living in other countries for a long time but wants to avail of housing packages when they retire or for their families.

Loan Details

Purpose: Construction of a house or new unit, purchase of a lot and construction thereon, or purchase of an existing residential unit.

Loanable Amount: Maximum of P2 million for low-cost housing loan. For socialized housing loan, loanable amount is up to P450,000.

Terms of the Loan: SSS home loan is payable in multiples of five years but not exceeding 15 years.

Interest Rate: 8% per annum for P450,000 and below, 9% p.a. for loans above P450,000 but not exceeding P1 million; 10% p.a. if the amount is over P1 million but not exceeding P1.5 million; and 11% p.a. for loanable amount more than P1.5 million to P2 million.

Allowable Collateral: TCT/OCT/CCT issued by the Registry of Deeds in the name of the principal borrower. Consequently, the property must be free from liens and encumbrances. The said property will be secured by Real Estate Mortgage (REM), which will also be annotated on the title of the property held for security. A pre-selling property is likewise accepted as a collateral.

Insurance Coverage: This includes fire insurance, mortgage redemption insurance, and home guaranty corporation coverage, which will be paid for by the borrower.

SSS Home Loan Requirements:

1. Borrower must be a certified OFW, voluntary member of SSS with at least 36 months contribution and 24 months continuous contributions. Consequently, he/she must not be more than 60 years old at the time of application.

2. Borrower must not have a previous grant of SSS home loan or final SSS benefits.

3. Borrower must submit the following documents upon application:

- Application for Housing Loan with attached 1×1 picture of the borrower.

- Certification from POEA/DOLE/OWWA/SSS to prove that you are an overseas Filipino worker

- Certificate of Loan Eligibility, which you can get for a fee of P100

- Deed of Sale or Contract to Sell of the property you are applying for

- Appraisal Report from accredited appraising companies of Home Guaranty Corporation

- Certificate of Acceptance and Occupancy signed by the borrower in case the property is 100 percent complete

- Photocopy of Tax Declaration and Real Estate Tax receipts

- Certified true copy of the title of the property to be mortgaged

- Lot plan with vicinity map

- Blue print of the building home

- Notarized Special Power of Attorney if the filing of application is made via representative

- Tax mapping or subdivision plan

- 12 post-dated checks to cover the fees

You may submit your application at the nearest SSS cluster branch or in Housing and Business Loans Department in SSS Building in Diliman, Quezon City.

Who are Loan Sharks?

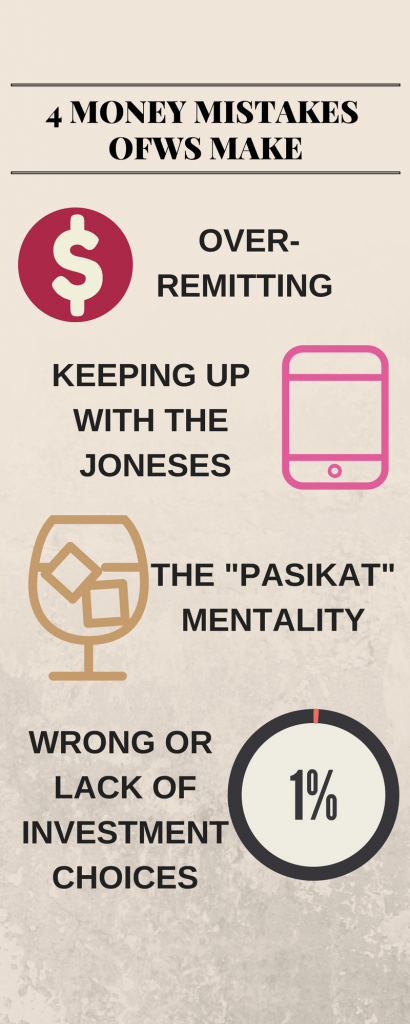

Who are Loan Sharks? 1. Over-remitting

1. Over-remitting

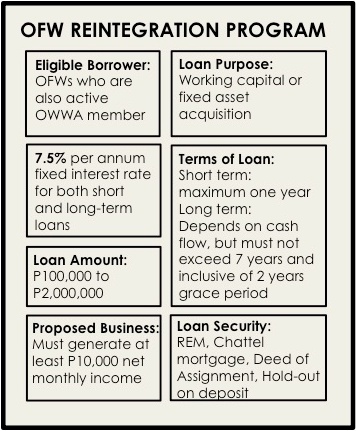

Understanding the OFW Reintegration Program

Understanding the OFW Reintegration Program