Are you a seaman who is in need of cash? Do you need money to finance the purchase of a car or to help you put up your own business? Then there is good news for you. Apart from the usual OFW Loan, many lenders also offer Seaman Loan exclusively for seafarers like you.

Seaman Loan is a type of financing option specifically designed for seamen and their families. Similar to other types of loan, a Seafarer’s Loan requires qualifications before you get approved.

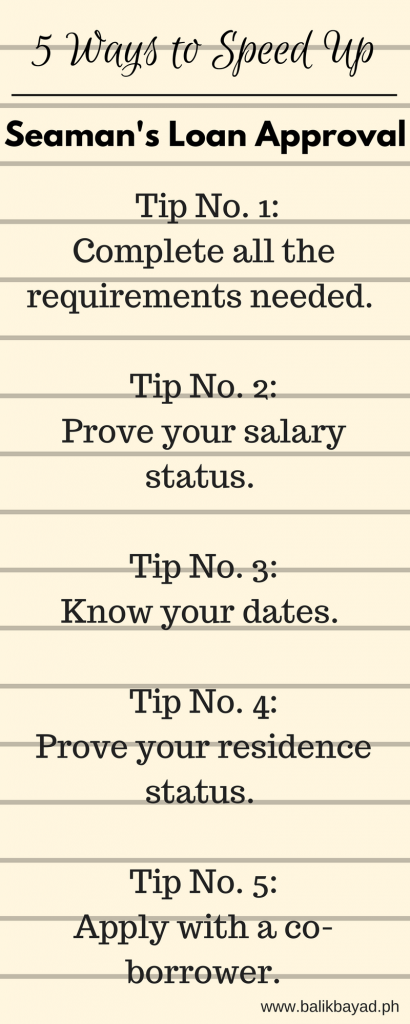

Don’t worry. There are many ways to help you get approved faster when you apply for a Seaman’s Loan. This includes:

1) Complete all the requirements needed.

Lenders deal with tons of applications everyday. They have to go through every set submitted to check if the requirements are complete and endorse the application for approval. If you are unable to submit a complete set of requirements, lenders will less likely prioritize your application.

Before you submit an application form, make sure that you have all the requirements needed, which includes birth certificate and government-issued IDs. If you want faster approval, don’t forget to provide documents that will show your capacity to pay such as Fleet Manager’s Recommendation or Joining Date Disclosure.

2) Prove your salary status.

Lenders are not willing to extend credit to everyone, most especially to those who are not capable of paying back a loan. To speed up your Seaman’s Loan approval, make sure that you are able to prove your capacity to pay by showing your salary status.

3) Know your dates.

There is a reason why lenders, regardless if you are borrowing from the government, commercial banks, or private lenders, ask for your Certificate of Employment or Overseas Employment Contract every time you apply for a loan. They need to know the status of your employment and when you are coming back.

Many OFWs think that just because you are abroad for two years (or more, depending on your contract), it will be harder for lenders to go after you. If they see that your employment is unsecured, they are less likely to extend credit.

What kind of dates should you provide? The Joining Date Disclosure, which you can get from your Fleet Manager, and Departure Date. These two will show lenders that you have a secured job and salary to pay for the loan.

4) Prove your residence status.

Do you know why lenders have soft spot on collateral loans? It is a form of assurance for them of your intention to return to the Philippines once your contract expires.

If you want to speed up your application and increase the chances of approval, secure your residence status through home ownership or use one of your properties as a mortgage for the loan.

What if you don’t have your own home yet? If you are living with your parents or relatives or have an ancestral home (don’t worry, it doesn’t have to be big), then you can use that to prove your residence status as well. Otherwise, you can try the next tip.

5) Apply with a co-borrower.

A co-borrower is common on non-collateral loan and whose role is to pay for the monthly amortization of the loan in case you failed to pay.

Lenders understand that not all OFWs have properties to help secure the loan. In that case, you can apply with a co-borrower since it also serves as an assurance that lenders can go after someone in case you missed a payment.

Do you want to make loan application easier for you? Then Balikbayad might be of help. Give us a call or send us a message and let’s talk about how we can help each other.

Useful and helpful tips!