We understand your need and the demands of everyday living. This is why aside from earning in dollars (or any other currency), you still want to put up your own business, regardless of how small it is, to contribute to the growing needs of your family.

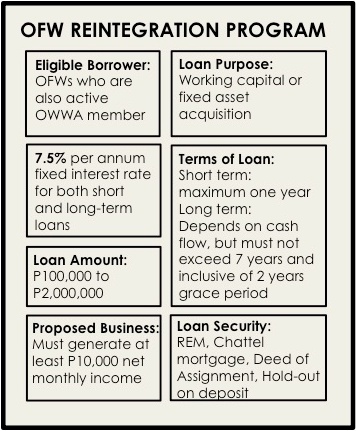

This is why OWWA Loan is here to help. It is designed to aid Overseas Filipino Workers in their entrepreneurial dreams by allowing you to borrow as much as P2 million. At the same time, this facility encourages you to stay in the country for good through a sustaining and profitable business.

Here’s the thing: it’s not easy applying for an OWWA Loan. OWWA wants to make sure that they will extending credit to the most deserving workers where the money will be used for a legitimate purpose. More importantly. OWWA wants OFWs who are not only willing but also capable of paying the loan.

Here’s what you need to do to boost your chances of approval:

Verify your OWWA and OFW Status

One of the requirements for OWWA Loan is that the OFW-borrower must be an active OWWA member, as shown through your proof of contribution.

In case you are still working abroad, you can still get your membership certification from OWWA through the Welfare Officer in the Philippine Embassy in the country where you are working. Don’t forget to get your membership certification in OWWA Office once you are back in the Philippines.

Complete the documentary requirements

Once you verified your status as an OFW, it is time to complete documentary requirements needed by OWWA and Land Bank (partner bank) to determine your credit-worthiness.

Below are some of the requirements needed:

- Certificate of Attendance proving that you completed the Enterprise Development Training (EDT). Read more about EDT here.

- DTI Business Registration Certificate (if sole proprietorship) or SEC Registration (if corporation)

- Two (2) valid government-issued IDs

- Biodata

- A formal business plan or contract growing, service contract, feasibility study, or purchase order.

- Business permit

- Income tax return (ITR) for the last three years

- Financial statements submitted to the BIR for the last three years

- Latest interim financial statement

- Special Power of Attorney (SPA) authorizing your spouse or any immediate family member to transact on your behalf in case you have to go back to the country where you’re working.

Don’t forget your collateral

This is required. Keep in mind that at the end of the day, OWWA and Land Bank want any form of assurance to make sure that they will still be paid in case of default.

Ideally, collateral is any piece of land under your name, the borrower. In case you don’t have a property under your name, you can submit the following as collateral:

- OR/CR of a vehicle under your name

- Proof of receivables

- Lease rental contract where your business is situated

- Contract agreements such as Deed of Assignment of goods or Purchase Order

- Apply with a co-borrower with good credit standing

Few more thing to remember

There is a higher chance of approval if you already have a ready market for your product or service. If the business you plan to put up has a projected monthly income of P10,000, then much better. EDT is also crucial, so make sure you call the OWWA Regional Office near you and ask for the schedule for the training.

OWWA Loan may be strict, that’s true. In case you want more relaxed application to help you grow your business, Balikbayad is here to help. Send your loan application now and we’ll help you grow your business – at the most affordable rate.

Understanding the OFW Reintegration Program

Understanding the OFW Reintegration Program