Covid-19 affected many things, including one’s financial state. Since you’re back in the Philippines, you might find it challenging to look for other sources of income. Unfortunately, lack of funds isn’t limited to lack of cash for groceries or payment of bills. This could also adversely affect your kids’ tuition fee.

Because of the pandemic and the sudden shift to online classes, you have no choice but to also spend on laptop or tablet, upgrade your Internet connection, and dedicate a space for your kids’ learning, which also means additional expenses.

The thing is at the end of the day, education is important. In case you are short in funds, student loan is something you can consider.

Here are some educational assistance programs you can look into to finance your child’s education:

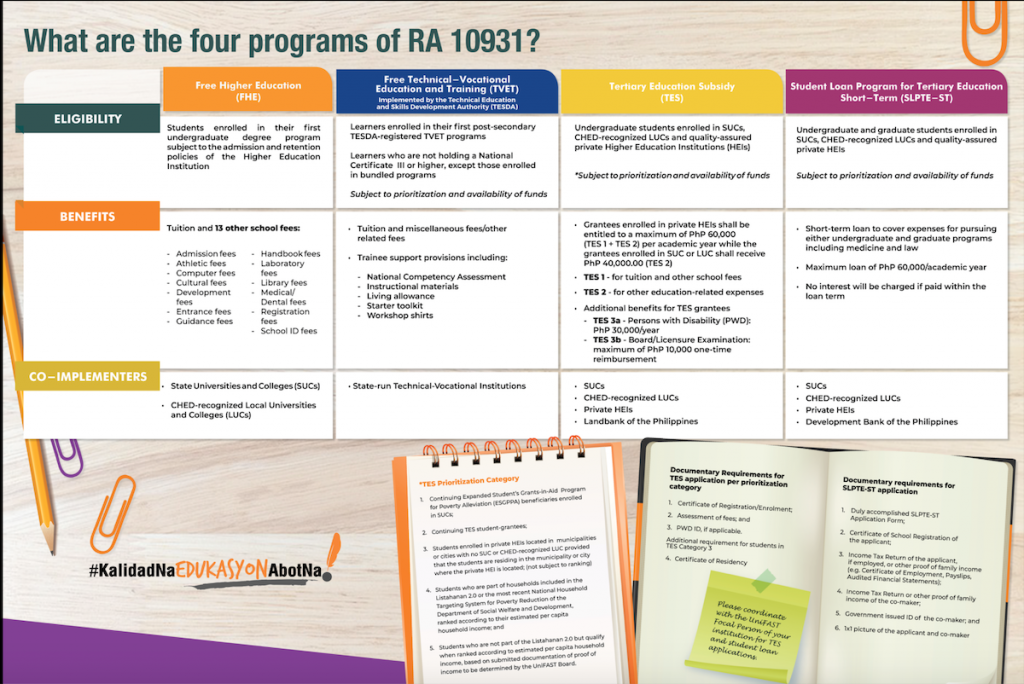

CHED’s Unified Student Financial Assistance System For Tertiary Education

Also known as UniFAST, the CHED Student Loan Program is open to all Filipinos who are undergraduate, graduate, medicine, and law students enrolled in public or private schools or universities. You can also borrow up to P60,000 per academic year, payable for one year.

Interest rate is zero percent IF the loan is paid before the semester ends. Otherwise, six percent interest will be imposed.

As of this writing, CHED Student Loan Program offers the lowest student loan in the country. To apply, make sure you submit the following documents:

- Three copies of accomplished Application Form. You can access it here.

- Photocopy of the applicant’s Certificate of School Registration

- Photocopy of applicant’s school ID

- Income Tax Return, payslip, Certificate of Employment, audited financial statements, or other proof of income of the applicant or applicant’s parents

- Co-maker’s ITR, other proof of income, and government-issued ID

- Two 1×1 photo of both the applicant and co-maker

Once you have all the documents prepared, submit the requirements to the office in charge of student loan applications in your child’s school. Thereafter, the school will forward the application to CHED.

If approved, then you will also be asked to open an account with the Development Bank of the Philippines since this is where the proceeds will be credited.

You can also learn more about the program here.

SSS Educational Assistance Loan Program

Known as EDUC-ASSIST, this student loan program is open to all SSS members below 60 years old, with monthly income of P25,000 or below, and with at least 36 posted SSS contributions, with six of which must be posted within the last 12 months.

You can borrow up to P20,000 per semester and payable up to five years for four- or five-year course OR up to P10,000 per semester and payable up to three years for two-year or vocational courses.

Interest is six percent per year. Take note that there is also a maintenance charge of two percent and penalty of one percent per month in case of late payment.

Below are the requirements:

- Accomplished application form. You can access it here.

- Valid ID

- Assessment or Billing Statement from the applicant’s school

- Proof of relationship to the applicant such as birth or baptismal certificate

- Proof of monthly income such as latest payslip, Certificate of Employment, ITR, or notarized Affidavit of Source and Amount of Monthly Income

- In case you cannot provide proof, you can issue a notarized Affidavit of No Income

You can submit the requirements to SSS branch near you. Make sure to present the original and photocopies of the mentioned documents. If approved, then you can claim the check from the Administrative Section of the SSS branch where you applied.

Unfortunately, this educational assistance program is only limited to one beneficiary. Also, online application is not yet available, which means you have to personally submit the application.

PAG-IBIG Multi-Purpose Loan

The agency’s Multi-Purpose Loan can be used for variety of needs, including payment for tuition fee and other school expenses. So if you are an active PAG-IBIG member with at least 24 months contribution, then you can apply for a multi-purpose loan to cover school expenses of your kids.

You can borrow up to 80 percent of PAG-IBIG regular savings with 10.5 percent interest per year. The loan is payable for up to 24 months with two-month grace period.

You can learn more about PAG-IBIG’s Multi-Purpose Loan here.

LandBank I-Study Program

If you need bigger amount for your children’s education, then Landbank can help. Through the I-Study Program, parents who are struggling in sending their children due to the pandemic can still do so to ensure education.

The bank’s I-Study Program allows you to borrow up to P300,000 with five percent per year interest. You can pay the loan in one year in case of short-term loan but for longer term loan, the amount plus interest is payable up to three years with one year grace period for the principal.

Other charges include loan processing fee, Documentary Stamp Tax of P1.50 for every P200, and penalty charges in case of late payment.

The good thing about this educational loan is that it covers all levels and not restricted to kids who are in college. In case you’re interested, you must prepare the following documents:

- Accomplished loan application form

- Valid ID of the borrower

- Proof of income such as Certificate of Employment, pay slip for the last three months, and ITR

- Proof of billing address from at least two utility companies

- Enrollment or registration form from the school of the beneficiary

- Form 138 or Certified True Copy for the previous semester or quarter

- Certificate of Good Moral Character from the school

- Schedule of payment of school fees and other expenses related to enrollment for each semester or the entire year

To apply, simply visit any Landbank branch near you. Make sure to bring all documents for verification. If approved, then you will be required to open a deposit account from Landbank for disbursement of funds. You can also check this link for more details.

There are still several banks and private institutions that offer student loans but so far, the ones enumerated here have the most affordable rates. Check them out and see which one suits best for your child’s needs. Don’t hesitate to ask for sample computations. More importantly, prepare all documents and make sure that you have a copy of the originals.

Although it may not seem a lot, the amount you can get can be helpful in getting your kids back to school.